Vertical Software companies: ‘hidden gems’ in niches

When we think about large, successful enterprise SaaS companies, the first names that come across our minds are Salesforce, Hubspot, Adobe, Workday, ServiceNow, et cetera. Not surprisingly, because these companies introduced radical innovations, scaled extremely fast and were able to show steep revenue growth year-on-year.

We call these companies horizontal software players: they deliver software solutions that can be adopted broadly in many different segments/verticals and across regions. Solutions of horizontal software players can be used by millions of customers, which makes their Total Addressable Market (TAM) almost infinitely large. Their go-to-market plan is about winning new customers, rapid market penetration and reaching a solid ratio between customer lifetime value (CLTV) and customer acquisition costs (CAC). This, however, requires significant investments, particularly in product development (since the solution must be flexible enough and able to support many different work processes and customer needs) and marketing & sales. Moreover, horizontal software players – by nature – often face global competition.

Over the past decade we noticed the rise of vertical software players: software companies targeting specific groups of professionals within a vertical market, for example accountants, lawyers, nurses, teachers or architects. What makes vertical software so unique and relevant for customers, is the deep domain knowledge that’s combined with (workflow) technology. Founders of vertical software companies often built a career in that specific vertical before starting a software company.

Horizontal vs Vertical software companies: differences in revenue growth and profitability

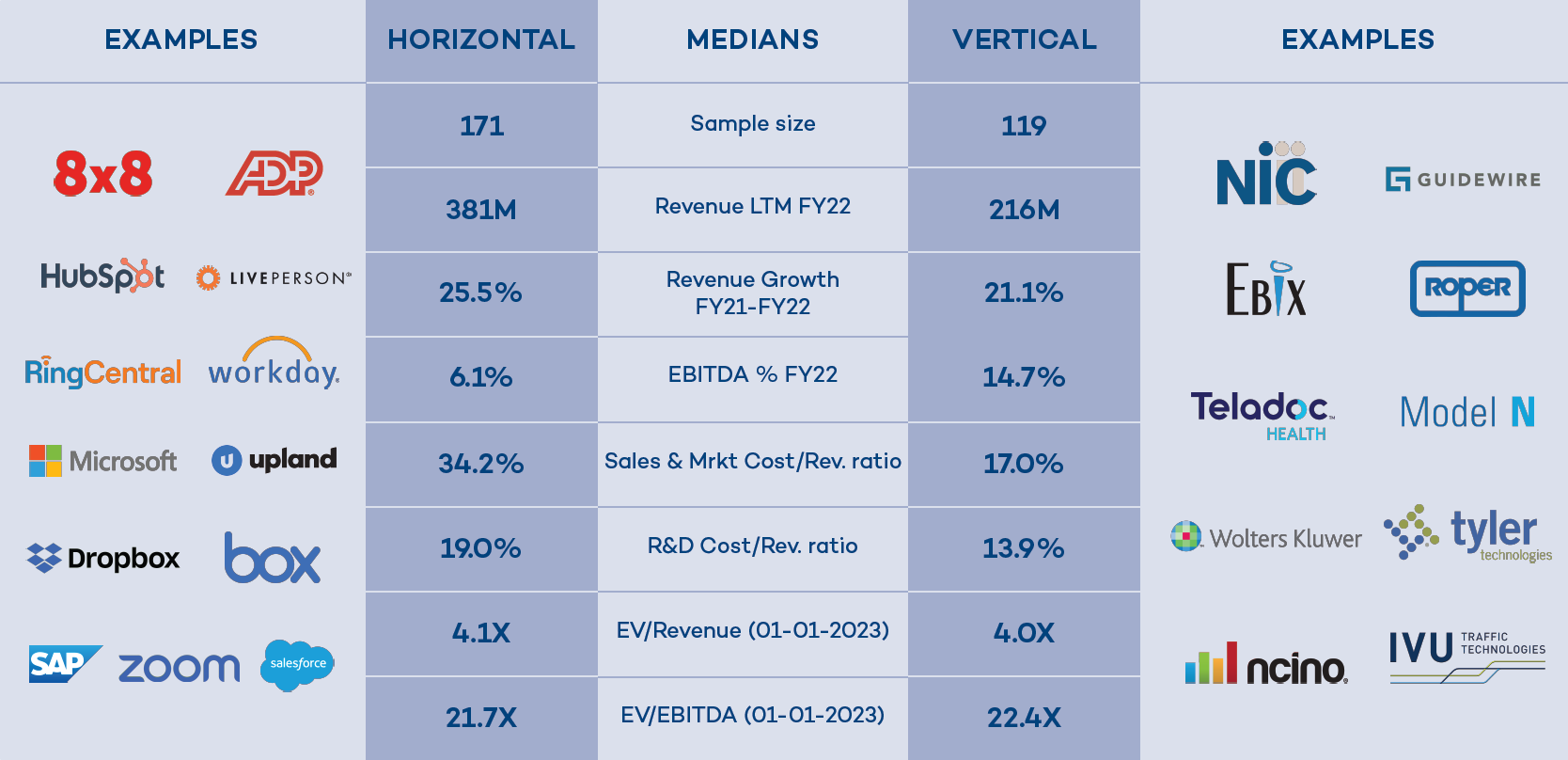

In our latest study (based on S&P CapitalIQ data), the Market Intelligence team of Main Capital sampled American and Western European publicly listed enterprise software companies and compared over 100 horizontal software players with over 100 vertical software vendors.

What did we find? First of all, vertical software players are more profitable than horizontal software players (15% vs 6% median EBITDA margin). This difference might be driven by:

- Focused product development/management.

- Targeted marketing & sales efforts (17% Sales & Marketing – Revenue ratio, compared to 34% for horizontal vendors).

Secondly, horizontal software players in general have larger revenues, and slightly stronger revenue growth, as compared to vertical software players. This can be attributed to the larger TAM a horizontal vendor can tap into.

Thirdly, we also looked at differences in valuation, and found minimal structural differences. Historically, the median EV/Revenue multiple of horizontal companies has been trading at a 0% to 20% premium as compared to the median EV/Revenue multiple of vertical players, while the median EV/EBITDA multiples of both company types have stayed within a narrow range of each other over time. We believe that valuation of a software company is influenced by many other factors than a horizontal vs vertical focus, like attractiveness of the segment, the growth profile, revenue predictability, experience of the management team, competitive positioning, scalability and technological status of the product suite. Moreover, for vertical software we assume that valuation – especially in uncertain times (like the COVID-19 pandemic) – is highly impacted by the dynamics in the specific end-market a software company is active in.

As a founder or investor -, both ‘pure’ horizontal and vertical software plays have obvious advantages and risks attached. A good way to mitigate risks, is by adopting a hybrid approach:

- Horizontal software players can focus on 3-4 specific end-markets (= specialization strategy).

- Vertical software players can spread their risk by developing product portfolios for 3-4 segments (= diversification strategy) or expand their TAM by looking at adjacent markets.

Main Capital’s take on this: vertical software investments in robust end-markets

Main Capital is a specialized, strategic investor in the enterprise software industry. We’ve built a strong portfolio of well performing software companies over the last 20 years. In our portfolio you see a blend of horizontal and vertical software companies. We definitely believe in strong horizontal areas like HCM and security software, and create solid software groups in these areas.

We also believe in investing in vertical software companies for the reasons outlined above, especially in robust markets: e.g. local governments & public administration, healthcare & social work, education, specialized business services, construction & property management and banking & insurance.

If you want to know more about this Market Intelligence research (there is a long-read available) and our view on the market, feel free to contact us. Also, if you are managing a software company and want to know more about working together with a strategic partner like Main, we’re happy to meet you.